Overnight Policy Rate Will Cause Ringgit Issue

When OPR is lowered other interest rates will be guided accordingly and vice-versa. Nevertheless a play on the ringgit will be driven by several events like FTSE Russell retaining Malaysia in the World Government Bond Index in its next half-yearly review in March 2020 global rating agencies the Fed ending the easing rate cycle thus providing room for Bank Negara Malaysia to institute one rate cut in the overnight policy.

Fitch Unit Suggests Bank Negara May Increase Opr Next Year To Protect Ringgit Revises Inflation Rate Upwards

As widely expected by economists such as Juwai IQIs Chief Economist Shan.

Overnight policy rate will cause ringgit issue. This in turn would. The Vibes file pic January 16 2021. Commenting on the OPR hikes impact on local.

Monetary Policy Statement. Note that the overnight rate is called something different in different countries. At its meeting today the Monetary Policy Committee MPC of Bank Negara Malaysia decided to maintain the Overnight Policy Rate OPR at 175 percent.

Breaking Down Overnight Rate. It is the target rate for the day-to-day liquidity operations of the BNM. This he says should lend support to the ringgit.

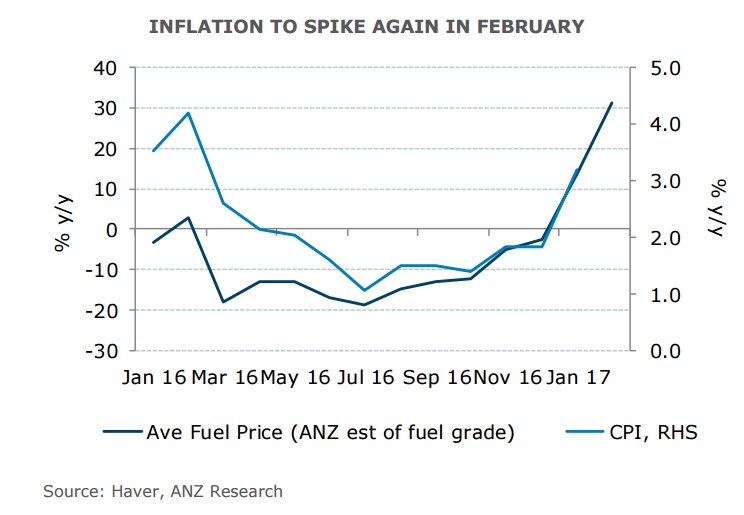

As the ringgit loses its value the price of goods and services would begin to rise. BNM Holds OPR Steady At 175 In First MPC Meeting Of 2022. As Malaysians usher in 2017 they are set to grapple with a weak ringgit and higher food prices.

The Malaysian central bank held its overnight policy rate at 175. The decision surprised market observers who had expected a further cut in light of the recent surge in new Covid-19 infections and the renewed limitations imposed on January 13th. 3 Overnight policy rate the interest rate set by the BNM at its monetary policy meetings.

At 9am the local note stood at 418901930 versus the greenback compared with 419351955 at Wednesdays close. KUALA LUMPUR Nov 4 Fitch Solutions a research unit of the Fitch Group said it expects Bank Negara Malaysia BNM to increase its overnight policy rate OPR by 225 per cent in 2022 in order. Consumer spending will be reduced as imported goods become more expensive pushing up inflation.

The overnight policy rate is an overnight interest rate set by Bank Negara Malaysia BNM used for monetary policy direction. This was decided at the Monetary Policy Committee MPC meeting today. March 3 Reuters - Malaysias ringgit and equities were little changed on Thursday after its central bank held lending rates steady while the Thai baht advanced after US.

2 Overnight policy rate trend. The Monetary Policy Committee MPC of Bank Negara Malaysia BNM has decided to maintain the overnight policy rate Overnight Policy Rate. Overnight rates are predictors of short-term interest rate movement in the broader economy and can have a domino effect on various economic indicators such as.

USD billions Annual change Sep 2009 Dec 2008 Sep 2009 Dec 2008 Total 2198 2097 72 128. The concept of the overnight rate is closely related to banking operations and liquidity issues. The overnight policy rate is an overnight interest rate set by BNM used for monetary policy direction.

Nevertheless a play on the ringgit will be driven by several events like FTSE Russell retaining Malaysia in the World Government Bond Index during its next half-yearly review in March 2020 global rating agencies the Fed ending the easing rate cycle thus providing room for BNM to institute one rate in the overnight policy rate political. HSBC Group which expects two rate hikes from Bank Negara in the second half of 2022 says. For example in the United States it is known as the Federal Funds rate while in Canada it is called the policy interest rate.

Meanwhile we see only minimal impact to banks earnings with respect to Marchs rate cut. OPR is the interest rate at which a depository institution lends immediately available funds balances within the central bank to another depository institution overnight. From November 2008 to February 2009 the rate was reduced three times from 35 to 2.

The OPR level will influence interest rates in other markets including credit market as OPR is the primary reference rate. The increase in oil prices came after a global agreement to. However it said any movement in the ringgit would be influenced by ongoing external and domestic challenges it said adding that the rate cut would probably cause bond yields to fall 15 per cent to 20 per cent in the near term.

Despite the impact of the COVID-19 pandemic the central bank said the global economies continued to strengthen including Malaysia. A rise in interest rates would help lift the ringgit which had depreciated to 40022 against the US dollar last Friday. 2 Loan approval rate approved loansapproved loans rejected loans.

Alex Cheong Pui Yin - 20th January 2022. At 9 am the local. The overnight policy rate OPR is determined by the Monetary Policy Committee MPC of Bank Negara Malaysia that meets six times annually.

The Bank Negara Malaysia BNM Monetary Policy Committee agreed to keep the overnight policy rate at its record low of 175 percent for the third time in a row. What is the Overnight Policy Rate OPR. KUALA LUMPUR March 3 The ringgit rebounded against the US dollar this morning buoyed by buying interest and supported by the firmer oil prices analysts said.

The overnight policy rate OPR is the interest rate at which a depository institution lends immediately available funds balances within the central bank to another depository institution. Negative for companies with high ringgit borrowings. The ringgit further improved against the US dollar after the Federal Reserve raised interest rates for the first time since 2018 in an effort to tame inflation.

It is the target rate for the day-to-day liquidity operations of the BNM. As of May 6th Bank Negara Malaysia has maintained the overnight policy rate OPR to 175. Indeed economists have warned that Malaysias inflation level.

This article first appeared in The Edge Financial Daily on December 27 2016. THE Jan 26 decision by Bank Negara Malaysia to increase the Overnight Policy Rate OPR by 25 basis points to 325 was met with generally positive reactions from economists and research houses with a future rate hike thought to be on the cards by some. Latest indicators show that economic activity picked up in most.

Fed Chair Jerome Powells testimony revived some risk appetite. Bank Negara Malaysia BNM has raised the overnight policy rate OPR by 25 basis points to 325 on July 10 2014 its first hike since May 2011. The market is expecting Bank Negara Malaysia to maintain the overnight policy rate at 175 which may cause the ringgit to test the 400 psychological level against the US dollar.

But any rate hike would have an adverse impact on the domestic economy not to mention household and national debt. The global economy continues to recover led by improvements in manufacturing and export activity. One of the tools the central bank has at its disposal to keep inflation in check would be to raise the overnight policy rate OPR.