Why Ringgit Strengthen 2018

A check showed that one Singdollar could buy RM30525. The ringgit further improved against the US dollar after the Federal Reserve raised interest rates for the first time since 2018 in an effort to tame inflation.

Ringgit Seen At Below 4 00 Against Us Dollar In 2018 The Edge Markets

The Singdollar rose against the ringgit on Thursday a trend that has continued since April.

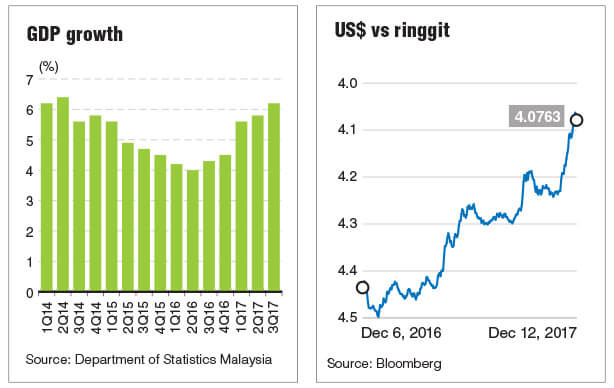

Why ringgit strengthen 2018. The ringgit is expected to strengthen to about 380 against the US dollar in the fourth quarter this year which is seven per cent stronger than its current level. The ringgit saw a mixed performance in 2018 despite entering the year on a bullish footing as the local currency was dragged down by a sharp change of sentiment in the second quarter heavily influenced by external drivers. Dollar since the second half of 2017 began with more gains ahead Affin Hwang said in a note on Friday.

Clearly the continued strength in our exports is critical to keep up the demand for and value of the ringgit. The USDMYR decreased 00095 or 023 to 41955 on Wednesday March 16 from 42050 in the previous trading session. Although the global energy and commodity prices are expected to trend higher in this year the trajectory of headline inflation will be dependent on future global oil prices which remain highly uncertain.

Malaysias ringgit has risen steadily against the US. At 9am the local currency opened stronger at 418151860 versus the greenback from 419651995 at yesterdays close. Affin Hwang Investment Bank Bhd head of research and chief economist Alan Tan Chew Leong said this would be fuelled by stronger commodity prices and normalisation of monetary policy in the.

Relative Strength Index RSI Source. On June 14 the Philippine peso reached a new record low. Our constructive view is that the ringgit has kicked off 2018 on a good start breaking the RM4 mark for the first time since August 2016.

But not only is the. Of course there are other circumstances that helped contribute to the further weakening of the Ringgit as well such as the election of Donald Trump as president the increase in interest rates by the US Federal Reserve taking foreign investors away from emerging markets of which Malaysia is one of them. A statement from Kenanga Investment Bank Bhd said the Ringgit was partly supported by strong fundamentals and positive sentiment on top of the weakness of the Dollar leading to its growing strength.

While the battery is not as long lasting as my Pebble watch 5 day vs 2 days for the Apple the brightness of the OLED screen the heart-beat sensor the size and how well it works with the rest of Apple devices Mac iPhone Airpods made this a must-have if you are heavily into the Apple. Growth pressures are being driven by an expansionary fiscal policy with the government set to keep doling out spending in the lead up to elections that. According to a report by Bernama the Ringgit is expected to test the 395 level against the US Dollar in the first quarter of 2018.

The currency has gained 14 in just the last five trading sessions. KUALA LUMPUR March 17 The ringgit further improved against the US dollar after the Federal Reserve raised interest rates for the first time since 2018 in an effort to tame inflation. Following up with strength The ringgit was one of the best performing major currencies of 2017 and we think that conditions are set fair for a continuation of that trend over the next 12 months.

Malaysian Ringgit2022 Data - 1992-2021 Historical - 2023 Forecast - Quote - Chart. On the contrary a strong inflow of capital would result in a higher demand for the currency as more foreign currencies are converted into the countrys currency strengthening the currency in the process. Historically the Malaysian Ringgit reached an all time high of 488 in January of 1998.

On expectation of continuing strong growth momentum in 2018 due to stronger global growth and positive spillovers from the external sector to the domestic economy the central bank increased the Overnight Policy Rate OPR by 25 basis points to 325 per cent on Jan 25 which helped strengthen the ringgit further. Current undervalued Ringgit against USD is partly due to 1MDB issues low oil price and government crony capitalism policiesimplemented since year 1980s. This is considered undervalued and economic conditions are also stronger than in 2008 and 2013 she said.

The Three Reasons Why The Rupee Is Strengthening. The Indian rupee continued to strengthen for the fourth straight session trading at its highest in two-and-a-half months. Ringgit strengthening and US weakening.

At 9am the local currency stood stronger at 418151860 versus the greenback from 419651995 at Wednesdays close. There is a reason why the ringgit appreciates and depreciates. Depending on the timing of further interest rate hikes in the US the ringgit may even weaken anew unless exports keep growing quickly and therefore continuously supplying more and more US dollar to the market.

It said the currency reached its peak for the year on the final day of 2020 up by 17 on Dec 31 to RM402 against the dollar its strongest. 4 US dollars renewed strength. Room for the dollar to continue underperforming in 2018 remains on the table driven by a more positive global growth outlook in.

The report also noted how Pakatan Harapans foreign investment policies has been made clearer for investors since taking over government in 2018 leading to a healthier investment outlook and strengthening ringgit come 2021. Malaysian Ringgit - data forecasts. Lee believes that a continued current account surplus clarity of policies fiscal and debt path and the affirmation of Malaysias sovereign rating could support the ringgit over the next six months.

Trading closed at P533 per US dollar the weakest it has been in 12 years. I recently bought a Apple Watch Series 3 Nike edition and I am pretty pleased with it. Bloomberg Our view Given the current strength of the ringgit we are revising our earlier calls of RM400 RM410 to RM395 RM405 by end of 2018.

It also expects a stronger ringgit exchange rate compared to 2017 will mitigate import costs. Jun 18 2018 857 AM PHT. It pointed to the liberalisation of the bond market and foreign-exchange hedging requirements in 2017 as spurring the ringgit higher with the dollarringgit touching 387 in late January.

Kamaruddin says greater clarity in policies and taking measures to beef up governance could boost the ringgit. On Tuesday it rose to 73 against the dollar up another 03. Major economic policy shift has been implemented and more reforms will kick in after 14th General Election of Malaysiadue by August 2018.

Ringgit Seen At Below 4 00 Against Us Dollar In 2018 The Edge Markets

0 komentar: